salt tax cap repeal

This significantly increases the boundary that put a cap on the salt deduction at 10000 with the tax cuts and jobs act of 2017. According to press reports the senate is considering repealing the 10000 cap on the state.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

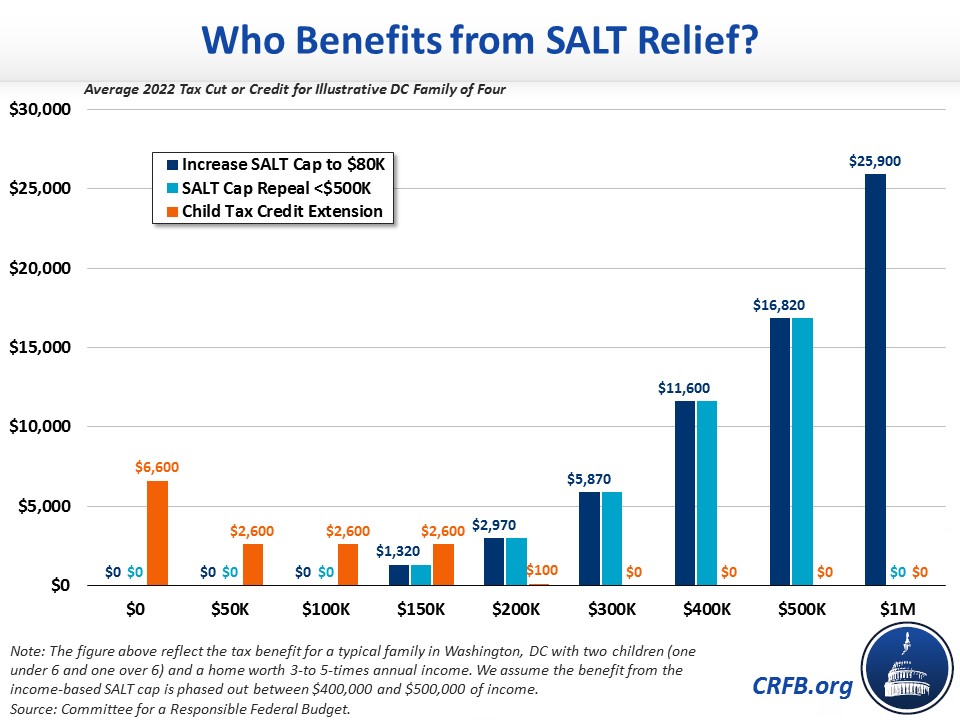

The Tax Policy Center found that only 3 of middle-income households would pay less in taxes.

. In November 2019 the US. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction according to. The congressional debate over the cap on the state and local tax SALT deduction is creating unusual combinations of groups advocating for and against repeal of the 10000.

A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state and. The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed. Analyses found that repealing the cap would disproportionately benefit the wealthy.

The SALT deduction benefits only a shrinking minority of taxpayers. The 2017 Tax Cuts and Jobs Act TCJA put a cap on such deductions but recently a number of lawmakers are advocating for a repeal or reform of that cap. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. The new group is a sign of increasing pressure to cancel the 10000 limit on the SALT deductions which was put in place in 2017 as part of former President Donald Trumps. The Tax Foundation predicts that a full repeal of the cap.

House Democrats push Treasury IRS for repeal of rule blocking state and local taxes cap workaround Published Fri Jun 3 2022 156 PM EDT Updated Fri Jun 3 2022 207 PM. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. House of Representatives passed a partial repeal of the SALT cap by a vote of 218206 with five Republicans voting for the bill and 16.

House Speaker Nancy Pelosi D-CA has suggested that a retroactive repeal of the cap on State and Local Tax SALT deductions should be included in any future stimulus plans. Three House Democrats say they wont support any of President Joe Bidens tax hikes to fund his infrastructure proposal unless the plan includes a repeal of the. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent.

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. The Brookings Institution explained that almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile 57 percent would benefit the top one percent a.

Over 50 percent of this reduction would accrue to. Salt Tax Cap Repeal 2022.

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Democrats Push 1 Friendly Salt Cap Repeal Amid Biden Calls For Tax Hikes On The Wealthy Fox Business

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Salt Cap Repeal Will Be Just Another Nice Thing For High Earners Bloomberg

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Car Nar 2022 Repeal The Salt Tax Cap Will Be Up For Vote

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

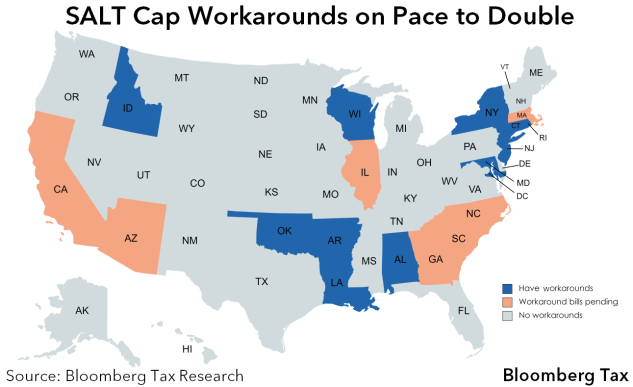

Unlock State Local Tax Deductions With A Salt Cap Workaround

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Marc Goldwein On Twitter New Analysis Build Back Better Might Deliver A Net Tax Cut To The Rich In The First Two Years A New Budgethawks Analysis Shows Why Salt Cap

Dems Don T Repeal The Salt Cap Do This Instead Itep

Salt Workarounds Spread To More States As Democrats Seek Repeal

Wealthy Democrat Donors Likely To Benefit From Democrats Repeal Of Salt Cap Fox Business

/cdn.vox-cdn.com/uploads/chorus_asset/file/22439062/1256311254.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

U S Appeals Court Rejects Challenge By 4 States To State And Local Tax Cap Reuters

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It